Summary: Analyzing your revenue cycle from start to finish can lead to recouping significant revenue dollars for your organization. Have you analyzed your revenue cycle lately? Do you know where to begin? To you know what to measure, how to measure, and how to analyze the results?

Summary: Analyzing your revenue cycle from start to finish can lead to recouping significant revenue dollars for your organization. Have you analyzed your revenue cycle lately? Do you know where to begin? To you know what to measure, how to measure, and how to analyze the results?

The new year has begun. As such, a review of your revenue cycle should be high on your mind. When is the last time you analyzed your revenue cycle from start to finish? Many practices lose significant amounts of revenue by not doing their due diligence with their revenue cycle. Just making a few tweaks can make the difference between operating in the red and being in the black. Very simply, the revenue cycle consists of three stages: pre-visit, visit, post visit.

Pre Visit

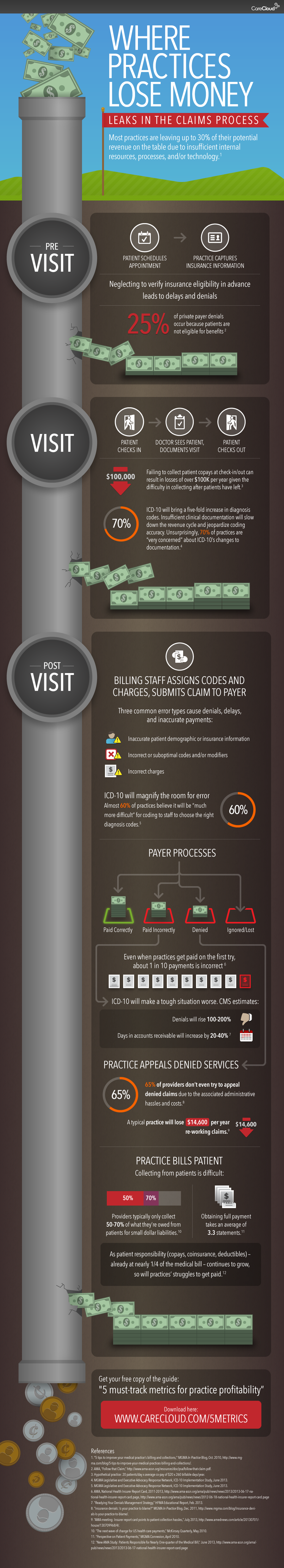

Getting the patient in the door is half the battle. A significant amount of revenue is lost during the scheduling process which can lead to missed appointments. Missed appointments are missed opportunities for revenue. Appointment calls, texts, and/or emails the day before or the morning of will reduce the number of “no shows”. In addition to appointment reminders, insurance information should be obtained and verified prior to the visit to ensure there are no surprises and validate whether or not the service will be “covered”.

Visit

Visit

Revenue can be lost through different stages of the visit. One of the biggest areas is failure to collect copays and coinsurance. Collecting these amounts after the patient has left your office becomes more and more difficult. The average time to collect is about 3 months if you are able to collect at all. Collecting copays and coinsurance when the patient walks through the door is critical to the revenue cycle. Meticulous clinical documentation is also essential to make sure the service can be billed appropriately. Making sure medical necessity is documented and the correct codes are included in the medical record will help to ensure that claims will be paid appropriately.

Post Visit

Ensuring your bases are covered for the time period up to and including the visit doesn’t let you off the hook. Post visit brings opportunities for revenue recoupment as well. Correct coding is critical especially with regulatory changes such as ICD-10. Failure to adapt to new codes can lead to denied claims. Submitting claims correctly requires crossing your “t”s and dotting your “i”s. An audit process should be in place to thoroughly review each and every claim prior to submission. Each payer has different requirements. Ensuring these specific requirements are adhered to will increase the probability of the claim be accepted and paid upon initial submission. Many dollars are lost through careless errors in claim submission process. Much time, energy, and resources are spent correcting and resubmitting claims. Many organizations don’t take the time to appeal a denied claim, hence another opportunity to recoup revenue. In general about 50% of denied claims are over turned. 50% is certainly better than nothing and certainly worth the time and effort to go through the process.

Summing it Up

The revenue cycle is very complex. Millions of dollars are lost as a result of failing to understand and properly analyze each step of the process. Additionally, knowing what and how to track in terms of key performance indicators and industry benchmarks can be a daunting task. BHM Healthcare Solutions has been extremely successful in assisting organizations in recouping significant revenue for our clients. Visit our Revenue Cycle webpage to learn more about our expertise.

RT @BHMHealthcare: Analyzing Your Revenue Cycle http://t.co/cBgC6ZOLdG

RT @BHMHealthcare: Analyzing Your Revenue Cycle http://t.co/cBgC6ZOLdG

RT @BHMHealthcare: Analyzing Your Revenue Cycle http://t.co/cBgC6ZOLdG

RT @BHMHealthcare: Analyzing Your Revenue Cycle http://t.co/cBgC6ZOLdG