Why Understanding Revenue Cycles Is Important

Understanding revenue cycles is crucial because it enables organizations to efficiently manage their finances in the healthcare industry. It ensures timely billing, reduces revenue leakage, and maximizes reimbursement, ultimately leading to financial stability, improved patient care, and sustainable operations.

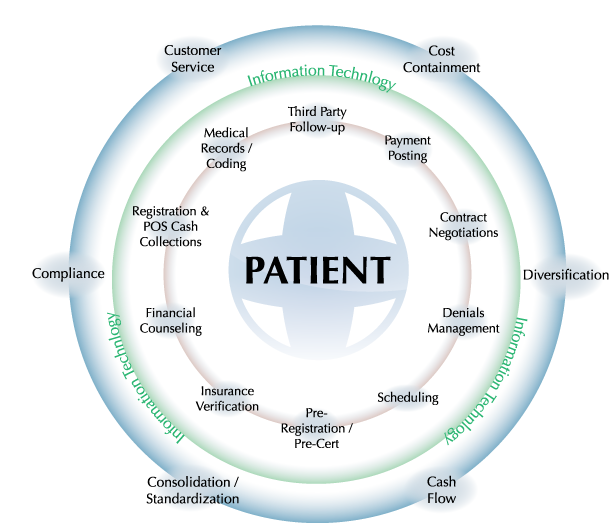

The circular nature of the process to left indicates that multiple claims on a single patient can be in different points in the process simultaneously. This makes coordination and communication between physicians, the coders and whoever else is dealing with the claim, critical.

1. Patient Encounter & Documentation

This process starts with registration but it starts taking shape during the visit. Then the physician makes notes regarding the nature of the visit, the procedures or tests ordered and is prepared to document when the encounter is complete. It is during this initial documentation that the process begins to take shape. Electronic health records (EHRs) increase proper documentation over time and help eliminate risk of coding errors.

2. Coding

Once the visit is in the hands of the medical coders, the patient has settled into the next phase of treatment. The next communication they receive is the first push towards payment. Medical coders work with a large percentage of patient charts each day. Medical errors occur when communication between coder and physicians is poor, which is turn impedes the overall process.

3. Quality Reporting & 3rd Party Payers

When a chart is coded and ready to be submitted, it becomes less a picture of a patient’s records and much more a set of numbers, monetary and medical, for the health system or hospital. In the next phase we see the introduction of third party payers. This is another place where the process can be help up. Third party payers may disagree with the charges or pinpoint errors, resulting in a refusal to pay for the care. Errors and disputes need to fixed before the process can continue.

4. Payment Posting & Collection of Payment

It is during this phase where patient may be sought out by financial counselors to discuss payment plans and options. These financial counselors are ultimately looking to solidify some form of payment from the patient to the hospital directly. If this does not occur, the claim will eventually be taken off the hospital’s plate and left to a collection’s agency- which is not the happiest end to the process for anyone involved. Otherwise, we would assume that the claim is paid by the patient and the cycle simply begins again with new patients.

Review the cycle above and ask, “What are areas in my revenue cycle at my organization that are weak, or could stand to be improved upon?”

Understanding Revenue Cycles & Tips for Improvement

1.Expert & Steamlined Review Processes. The patient communication arena is one of the first places to look when you start revenue cycle improvements.

- Collect updated information at every visit

- Ask for insurance changes or edits

- Collect fees and copays up front

- Ensure patients know the bill pay process and expectations

2. Consider Outsourcing

When collectors and patients develop close relationships, sometimes those overdue balances hang out on the books longer than they should. Outsourcing not only frees up staff resources, but it adds objectivity, concrete follow-up, and better follow through on collection processes.

Payers look to contractors for help as healthcare reform continues to drive change in the industry. From cutting costs to processing claims, there is an urgent need among payers for outsourcing. Claims management services are expected to see the biggest spike in growth in the coming years because of these trends¹.

- Claims management

- Front-end/back-office operations

- Member management

- Provider management

3. Use Technology

Innovative and new technology can have significant positive impacts on your revenue cycle. With this comes the necessity of proper training, so be sure you’re not skimping in this department. Better software can increase seamlessness and help you keep better tabs on overdue bills, errors, and more. Remember that technology is at the forefront of understanding revenue cycles and how they can improve patient care across the board.