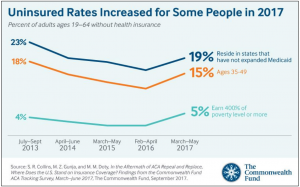

There was a significant change in for people ages 35 to 49, adults making more than 400 percent of the federal poverty level ($47,520 for an individual and $97,200 for a family of four), and those living in states that have not expanded Medicaid, according to a new Commonwealth Fund survey.

There was a significant change in for people ages 35 to 49, adults making more than 400 percent of the federal poverty level ($47,520 for an individual and $97,200 for a family of four), and those living in states that have not expanded Medicaid, according to a new Commonwealth Fund survey.

Policy fixes like expanding Medicaid in all states, making premium subsidies available to more people, and assisting consumers as they shop for coverage on the marketplaces, the report finds, could address some of the barriers the uninsured face in gaining coverage.

Uninsured Numbers Growing

According to The Commonwealth Fund’s fifth annual survey tracking the progress of the Affordable Care Act (ACA), despite the uptick in uninsured rates for some groups, the overall rate remained statistically unchanged from 2016 at 14 percent, representing an estimated 27 million working-age adults nationwide. The survey, conducted from March to June 2017, found that 13 million uninsured adults (48% of the uninsured) have incomes that would qualify them for Medicaid or for premium subsidies if they were to buy marketplace coverage. The remaining uninsured include 4 million people with incomes under the federal poverty level, which would qualify them for Medicaid if their state had expanded eligibility; 3 million people whose incomes are too high to qualify for premium subsidies; and 7 million foreign-born Latinos, who may be ineligible for coverage because they are undocumented.

“In the years since the Affordable Care Act was passed, more than 20 million Americans have gained health insurance,” said Sara Collins, Vice President for Health Care Coverage and Access at The Commonwealth Fund and the report’s lead author. “However, there are weak spots in the law that will need to be addressed if we are going to ensure that everyone who is eligible is able to enroll. The good news is that there are several ways to achieve this goal, including expanding Medicaid in all states, making premium subsidies available to more people, and helping people sign up for plans.”

What Will It Take to Get the Remaining Uninsured Covered?

The report also suggests policy options to help millions more people gain coverage:

- Providing enrollment assistance. Helping people shop for coverage on the ACA marketplaces makes a difference. Two-thirds (66%) of survey respondents who received help when they shopped for plans enrolled, compared to fewer than half (48%) of those who did not have this help.

- Raising awareness. Forty percent of uninsured adults were not aware of the marketplaces. Uninsured racial and ethnic minorities and those with low incomes were the least likely to be aware of the marketplaces.

- Making premium subsidies available to more people. Currently, subsidies are capped at four times the poverty level—about $48,000 for a single person and $98,000 for a family of four.

- Expanding Medicaid in all states. If the 19 states that haven’t expanded Medicaid did so, millions of uninsured adults would likely gain coverage.

“To achieve a U.S. health care system that ensures everyone can get high-quality, affordable care, we must extend coverage to as many people as possible,” said Commonwealth Fund President David Blumenthal, M.D. “While the ACA has made great strides in driving down the uninsured rate, there are many who still don’t have the security of good health insurance coverage. But there are several potential policy fixes available that make this a largely solvable problem.”

Additional survey findings

In addition to the experiences of the uninsured, the report looked at consumers’ experience shopping for, enrolling in, and using marketplace health insurance plans. It found that:

- Large majorities of marketplace and Medicaid enrollees are satisfied with their plans. Eighty-two percent of marketplace enrollees and 94 percent of Medicaid enrollees were very or somewhat satisfied with their plans.

- Subsidies keep premiums affordable for those with low incomes. Adults with lower incomes have an easier time affording their marketplace premiums than those with higher 3 incomes. While about two-thirds (64%) of people with incomes below 250 percent of poverty (about $30,000 for a single person and $61,000 for a family of four) said their premiumss were very or somewhat easy to afford, just one-third (34%) of people with incomes above those levels said the same.

- Cost-sharing reductions work. Twenty-eight percent of people in marketplace plans with incomes under 250 percent of poverty reported deductibles of $1,000 or less, compared to 67 percent of those making above that.

- Repeal-and-replace efforts prevented people from enrolling. Thirty-four percent of uninsured adults who knew about the marketplaces did not look for plans because they were concerned the ACA would be repealed.

- Cost was the primary reason people did not enroll in a plan. Three-quarters (74%) of uninsured adults who visited the marketplaces and didn’t enroll in a plan or get other coverage said they could not find a plan they could afford. However, 66 percent of people who said they didn’t enroll in a plan because they couldn’t afford it had incomes that would qualify them for premium subsidies or Medicaid.