Findings from the 11th Annual ReviveHealth Trust Index™ reveal trust in healthcare is dismal across the board, and trust in . The survey represents the first 360-degree view of trust in healthcare – digging into consumer, physician, health plan, and health system executives’ views of each other – showing the industry as a whole has a long way to go.

Findings from the 11th Annual ReviveHealth Trust Index™ reveal trust in healthcare is dismal across the board, and trust in . The survey represents the first 360-degree view of trust in healthcare – digging into consumer, physician, health plan, and health system executives’ views of each other – showing the industry as a whole has a long way to go.

Factors driving widespread distrust in health plans by provider organizations include the hassle of doing business with payers and a lack of progress toward new models of payment and care. Consumers feel slighted by health plans as well, compared to the higher trust ratings in physicians and hospitals.

In addition to dissatisfaction with their healthcare coverage, it is evident that for payers, consumer-driven healthcare is simply lip service. When asked to rank factors driving the transition to value, health plans selected “public sentiment about healthcare costs and coverage” dead last. Consumers’ lack of trust in the industry is perhaps best captured by the finding that nearly two-thirds of respondents would prefer “Medicare for all” over the current system.

Health Plans Hit New Low

Focusing on consumers in this year’s survey brings a new level of depth to the findings which have historically focused only on B2B aspects of health services. Key findings by audience included:

Consumers:

- On a 100-point scale, consumers’ level of trust in health plans scored 69.0.

- Consumers trust health plans least, followed by hospitals (74.2) and physicians (79.3). Part of consumers’ distrust of health plans is explained by a 4:1 margin of respondents noting their healthcare coverage has worsened.

Health System Executives:

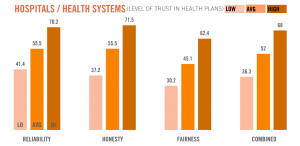

- On a 100-point scale, health system executives’ level of trust in health plans had an aggregate score of 52.0 out of 100.

- Health systems gave the highest scoring health plan a 68 and the lowest health plan a 36 – a huge variance between best and worst rated plans.

- Health system respondents reported expecting 88 percent of their revenue coming from volume vs. value, while health plans expect only 53.5 percent of 2017 claims will be based on volume.

- Contributing to the low level of trust, 63 percent of health system respondents believe further health plan consolidation would have an “entirely” or “mostly” negative affect on their business.

Health Plan Executives:

- On a 100-point scale, health plan executives’ level of trust in health systems scored 68.4, which is 16 points higher than health systems’ trust in health plans.

- Health plans gave the highest scoring provider organization 75 and lowest scoring provider organization 59.4.

- More than 38 percent of health plan executives surveyed said it has gotten harder to negotiate contracts with provider organizations year-over-year.

- Health plans rate fairness seven points lower (63.3) than honesty (69.8) and reliability (72.1), the two other measures of trust, when it comes to health systems.

Physicians:

- On a 100-point scale, physicians’ level of trust in health plans was only slightly higher than it was last year, scoring 55.8, but has not yet neared the high score recorded in 2015 (58.1).

- Physicians gave the highest scoring health plan 58.4 and the lowest scoring a 52.8.

“Consumers’ lack of trust in the industry – regardless of age, educational level, political preference or socio-economic status – should come as no surprise given the complexity of the healthcare system and how little healthcare’s central players trust each other,” said Brandon Edwards, chief executive officer of ReviveHealth. “Our research shows that consumer desire is not driving the transition from volume to value-based care. If the onus continues to be placed on individuals to manage their financial responsibility for healthcare, it’s reasonable to expect physicians, health systems, and health plans to band together to close the trust gap amongst each other and their customers. That’s the call to action for our industry, and it’s an urgent imperative.”

If any one industry group needs to look inward and make operational adjustments more than the others, it is health plans. Payors received a collective failing grade in this year’s Trust Index™ (59.1 out of 100), attributable to a slew of factors including aggressive negotiation tactics, increased market share and narrow networks, and administrative inefficiencies.

“The difference in satisfaction in different health plans was greater than it was among any of the other industry groups,” said Dan Prince, VP Customer Engagement, Catalyst Healthcare Research. “While all six health plans performed poorly, Cigna received the highest combined score among any plan in the past four years by a very narrow margin. UnitedHealthcare received the lowest composite score for the same time period. Industry counterparts and consumers have had historically low trust in health plans overall, but the results show some are faring better than others.”

The state of trust in healthcare is poor, and the survey results point to its continued decline. There’s opportunity, however, for industry organizations to leverage communication, amongst one another and their customers, to strengthen trust. With more – and more effective – communication between industry cohorts, the patient experience can improve. Consumer trust in the healthcare system will follow.

“Through our research, we’ve identified four core drivers of trust that must exist between these industry partners to improve overall trust in the healthcare system,” said Edwards. “With communication, consistency, compassion, and competency in play, progress is possible.”

ReviveHealth partnered with Catalyst Healthcare Research to administer the survey again this year, conducted June 6 – August 11, 2017. A total of 1,369 complete responses were collected: 604 consumers, 600 practicing physicians, 117 hospital and health system executives, and 48 health insurance executives.