Want to make a lot of money in healthcare? Don’t become a doctor.

This week the New York Times ran an article about the top earners in healthcare- and perhaps a surprise to none, doctors did not top that list: administrators did.

The Cost of Resistance | Clinical Coding Optimization

Physician practices may be lagging behind hospitals when it comes to implementing coding software. The hesitation to do so is costing them not only efficiency in coding, but reimbursements withheld due to avoidable errors.

Understanding RVUs and Medicare Reimbursement

Summary: Do you understand Relative Value Units (RVUs) as they relate to Medicare reimbursement? Is your physician compensation model based upon RVUs or a derivative thereof?

What is an RVU?

RVU stands for Relative Value Unit and is currently used by Medicare to determine the amount of reimbursement to providers. RVUs are basically a way of standardizing and comparing service volumes across all continuums.

Medicare Advantage Cuts Not Only Delayed But Reversed

Summary: CMS has reversed its original proposal to cutback Medicare Advantage plan reimbursement for 2015. The reversal is a result of aggressive lobbying from organizations such as the American Medical Association.

What is Medicare Advantage?

According to www.medicare.gov, a Medicare Advantage plan is “a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits. Medicare Advantage Plans include Health Maintenance Organizations, Preferred Provider Organizations, Private Fee-for-Service Plans, Special Needs Plans, and Medicare Medical Savings Account Plans. If you’re enrolled in a Medicare Advantage Plan, Medicare services are covered through the plan and aren’t paid for under Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage.”

Providers: Shifting Landscape and Mindset

As a result of the Affordable Care Act as well as other healthcare legislation, a shift is occurring in healthcare from the provider’s perspective. In order just to survive (not even prosper), physicians are changing the way they conduct business and choosing which patients will be seen.

Shifting Landscape and Mindset – Changes in Medicare

•Medicare reimbursement is certainly on the forefront. Reductions, even if 1% or less, can drastically affect a provider’s bottom line. Consequently, some providers are limiting the number of Medicare patients seen by their practice. Some providers have completely eliminated access to these patients.

Hospital Acquired Infections: The Diagnosis That Could Have You Paying an Extra $40,000 Per Patient

Hospital Acquired Infections (HAIs) occur when a patient is exposed to a bacterium, virus or fungi during their hospital stay that leads to an additional condition. These additional conditions can cost hospitals thousands of dollars in lost revenue.

Observation Units – Bridging the Gap Between Inpatient and Outpatient

What is CMS doing to reduce healthcare costs? CMS has added observation units which are an additional level of care between inpatient and outpatient.

What Are Observation Units?

In general, observation units are used to bridge the gap between inpatient and outpatient. They are designed for the patient in which the attending physician cannot determine whether a patient should be classified as outpatient (released within 48 hours) or inpatient (expected to stay at least 2 midnights). The observation units enable the physician to have a bit more time to stabilize the patient and based on medical necessity determine the estimated length of stay. They are billed as outpatient and do not count toward an inpatient admission.

Readmissions – Reducing Readmissions Through Collaborative Efforts

Readmissions have become a focal point over the last couple of years, especially for CMS. The costs have risen to the point of assessing penalties to hospitals whose readmission rates are above the expected and/or standard.

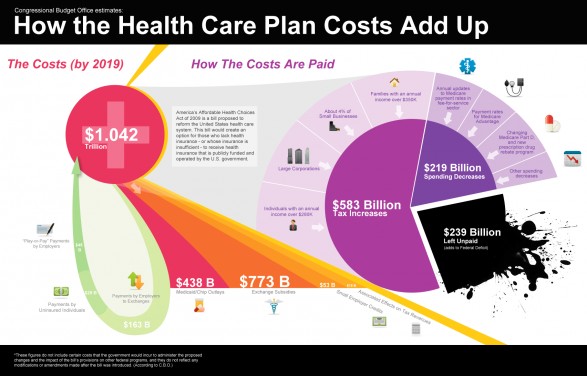

How the Health Care Plan Costs Add Up

What makes up the federal deficit? What will the costs be by 2019? How are those costs paid? How do the exchange subsidies factor in? How about the Medicaid expansion? How about the individual and employer mandates or more appropriately the penalties for noncompliance?

6 CMS Bundled Payments of Care Improvement Innovations Under the ACA

The ACA promotes quality of care as well as coordination of care. We will discuss 6 bundled payment initiatives/demonstrations CMS is piloting to achieve these goals.