Summary: The individual mandate becomes effective January 1, 2014. Do you have coverage and does it comply with the essential benefits requirement?

Summary: The individual mandate becomes effective January 1, 2014. Do you have coverage and does it comply with the essential benefits requirement?

In keeping with the holiday spirit, we thought it only fitting to write a series about the 12 days of Obamacare. On the first day of Obamacare, Obama gave to me….. an individual mandate. Like it or not, the individual mandate becomes effective January 1, 2014.

The individual mandate is one of the controversial provisions included in the Affordable Care Act which requires all (with few exceptions) each and every American to be covered by health insurance which meets certain minimum qualifications. These qualifications are called essential benefits. The controversy focused on whether the mandate was actually a tax or not and whether this provision was unconstitutional. The final result was to deem the provision to be a “mandate”.

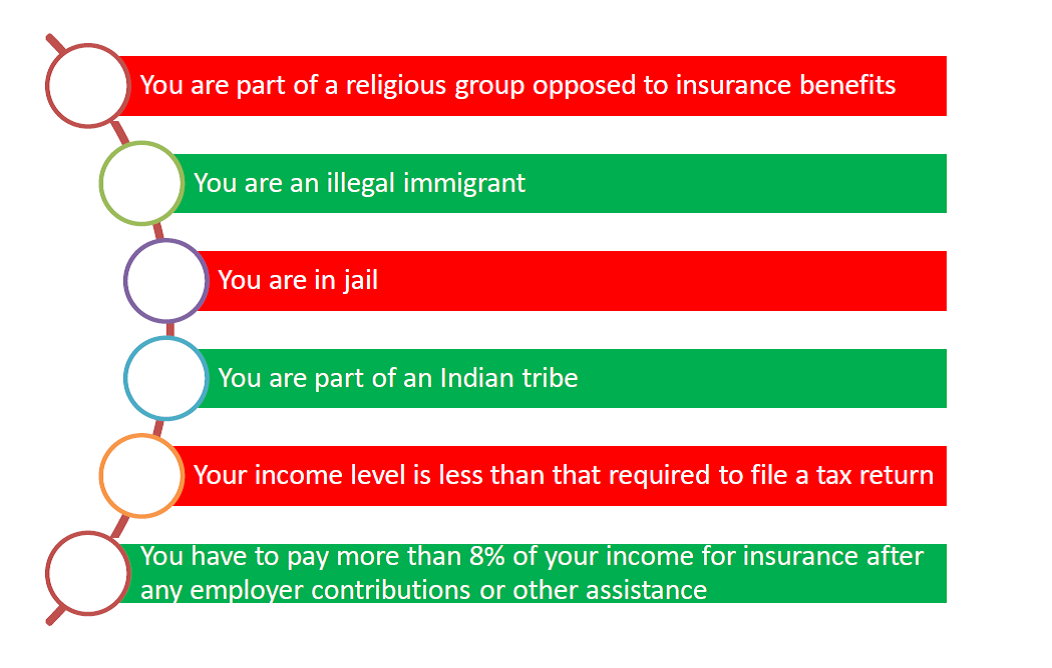

As mentioned above, there are certain exceptions to circumvent the dreaded individual mandate. The exceptions are:

If you have health insurance, it must satisfy each of the ten essential benefits, beginning January 1, 2014.

The essential benefits of the individual mandate include:

- Ambulatory care

- Emergency services

- Hospitalization

- Laboratory Services

- Maternity and Newborn Care

- Mental Health Services and Addiction Treatment

- Rehabilitative Services and Devices

- Pediatric Services

- Prescription Drugs

- Preventive and Wellness Services and Chronic Disease Treatment

Insurance companies have been working on their plans to make sure they comply with the new regulations. It is definitely worth your while to contact your insurance company to make sure that your coverage is in compliance.

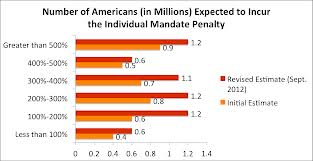

So, what does the mandate mean? Basically if you don’t qualify for the one of the exceptions above and you do not have health insurance coverage as of January 1, 2014, you will face a penalty.

Individual Penalties for Individual Mandate Provision

The penalties for 2014 for an individual are the greater of 1% of your income or $95. For 2015, the penalty is increased to the greater of 2% of your income or $325. For 2016, the penalties will be the greater of $695 or 2.5% of your income.

Family Penalties for Individual Mandate Provision

The penalties for 2014 for a family are the greater of 1% of your income or $285. For 2015, the penalty is increased to the greater of 2% of your income or $975. For 2016, the penalties will be the greater of $2,085 or 2.5% of your income.

The actual dollar limits don’t seem too bad, but let’s say you are a family earning $100,000. In 2014, you would pay a $1,000 penalty, which would increase to $2,000 in 2015 and $2,500 in 2016.

What are your thoughts on the mandate? Do you think you should be required to carry insurance coverage or do you think you should have the right to choose? What are your thoughts on the penalties? Are they too steep?

About BHM Healthcare Solutions – https://bhmpc.com/

BHM is a healthcare management consulting firm whose specialty is optimizing profitability while improving care in a variety of health care settings. BHM has worked both nationally and internationally with managed care organizations, providers, hospitals, and insurers. In addition to this BHM offers a wide breadth of services ranging including healthcare transformation assistance, strategic planning and organizational analysis, accreditation consulting, healthcare financial analysis, physician advisor/peer review, and organizational development.

Contact Us : re*****@*******pc.com, 1-888-831-1171

For a complimentary consultation to see how we can assist you with your healthcare consulting needs, please click on the icon below.