Often in our blog we underscore the importance of understanding healthcare reform and how it will impact your organization. Today we wanted to take a look at a few of the major ways that healthcare reform will impact the revenue cycle, and what some organizations are proactively doing to make sure that the reform impact is a positive one. Let’s begin our exploration of healthcare reform and the revenue cycle!

Often in our blog we underscore the importance of understanding healthcare reform and how it will impact your organization. Today we wanted to take a look at a few of the major ways that healthcare reform will impact the revenue cycle, and what some organizations are proactively doing to make sure that the reform impact is a positive one. Let’s begin our exploration of healthcare reform and the revenue cycle!

1. Expanded Coverage means that emphasizing an effective eligibility process is more critical than ever.

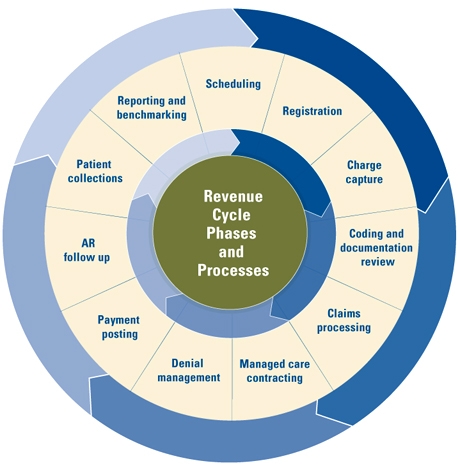

Your revenue cycle begins when a patient, or prospective patient contacts your office to make and appointment and provides their name, number, and insurance information. Due to the Affordable Care Act there will be an expansion in the number of individuals who are now covered by some type of health insurance whether exchange based policies, private policies or Medicare/Medicaid. This is good news as many providers are anticipating and increase in the number of patients seen, and now that individuals have coverage it should be easier for providers to ensure that they receive appropriate payment for services rendered…………..however, if your organization does not have a sound eligibility process in place you could feel the pinch of expanded volume without appropriate reimbursement. Here are some strategies which have yielded positive results for other organizations:

- Centralize your authorization department and your insurance verification and pre-registration units – Make this an organizational emphasis and a department with one goal and one objective. Authorizations can more effectively be taken care of if there are select members of staff delegated to this responsibility and they know the process inside and out

- Streamline the process whenever possible through pre-registration, online registration, and automated verification of prospective patients (both established patients and new patients). Don’t wait for someone to show up for their appointment to verify their coverage. Take steps to try to get verification and authorization ahead of time, every time.

- Make it a policy to know what the financial obligation of the patient is before the visit, make them aware of this, and collect ahead of time if possible! Practices which collect co-payments via online payment systems, or telephonic payments made at the time of appointment scheduling have decreased no-shows by up to 80% and increased cash collections by up to 92%

2. The payer mix of your organization will most likely be changing, be proactive in knowing what your payer mix is and how to most effectively plan a strategy for the future.

There will be large increases in Medicare/Medicaid recipients due to the Affordable Care Act, and even those who were previously insured may be switching plans and/or coverage. 2014 will be a critical year for practices to track their payers, and be diligent about understanding their payer mix so that they can appropriately predict their reimbursement rate, and look for financial opportunities when it comes to contacting and negotiations.

- know you patients and anticipated volume of new patients and break them out by payer

- Make sure you understand reimbursement rate differences between payers

- Track recurring issues (especially denials!) by payer, and keep of file of these issues. This will be critical during contract negotiations

- Remember that you can impact your payer mix, do you need to attract more privately insured individuals? Do you want to increase the volume of Medicaid/Medicare patients? Find out what makes the most sense for your practice and market accordingly.

3. Understand the economic incentives available for your organization and take strategic advantage of these when it makes sense for your practice.

The Affordable Care Act brings great change, but can also be a time of opportunity for those organizations who have a clear plan and focus on incentives. Some of the incentives which will be available associated with the Affordable Care Act include:

- Bundled Payments

- Pay For Performance/Quality Incentives

- ICD-10 Implementation

- Documentation and Coding Updates

- EHR/EMR Payments

- Participation with Accountable Care and Managed Care Organizations

There are a variety of programs that offer financial incentives for pilot participation as part of the overall healthcare reform movement, but not all will be appropriate for every organization. A healthcare financial analysis can be key in determining which incentives make the most sense for your healthcare organization. Similarly there will be incentives related to coding/documentation and Electronic Medical Record Implementation. While these will eventually be mandatory, early adopters can see financial benefit. Organizations will need to evaluate what makes sense now, and what investments will provide substantial long term rewards for their organization.

Begin with a Healthcare Financial Analysis

Whether conducted by a consulting firm, or done in house it will be critical for healthcare organizations to complete a thorough healthcare financial analysis for their organization in which strategic planning related to healthcare reform, the Affordable Care Act, and other opportunities takes place. Now is a time of tremendous change for organizations, and unfortunately, not all will be successful in the new healthcare reform environment. Ensure that your organization is prepared for the reform journey ahead by taking a long hard look at your organization, its current operations, and its opportunities in the future. Healthcare reform and the revenue cycle go hand in hand, now is the time to prepare your organization.

Making the First Step Easy

Not sure where to being in preparing your revenue cycle for optimization in the face of reform? Simply click the below button for an exclusive one hour consultation with one of our healthcare revenue cycle experts.