Open enrollment for health insurance under the ACA may have ended February 15, but an extra enrollment period (Special Enrollment Period) will take effect March 15 to April 15. So if you missed the deadline, you might have a few options to get coverage. There’s a myriad of situations that qualify you for the extension, so you’ll want to head over to Healthcare.gov to take the screener. Today what we want to talk about are ObamaCare Subsidies. Often tricky and confusing ObamaCare subsides are there to help lower the cost of your healthcare premiums. Do I qualify? What if I qualified before but I don’t now? These are just a few of the questions we hope to answer with the resources below.

1. What is an ObamaCare Subsidy?

ObamaCare subsidies are credits put in place to help lower your monthly insurance premium. There are Premium Tax Credits, where you get your tax credit in advanced (instead of waiting until you file your taxes the next year) and Cost Sharing Subsidies, which means you’ll pay lower deductibles, coinsurance, and co-payments. The amount of the subsidy you receive is based on your household Modified Adjusted Gross Income (MAGI).

2. What data do I need?

First, you’ll want to gather all your data. You’ll need your MAGI at hand to figure out where you stand. This great infographic from eHealth helps outline what data you’ll need to begin. You’ll need about an hour of time (you don’t want to rush yourself), your income information, citizenship documents or SSN, and your current healthcare information.

3. Do I qualify?

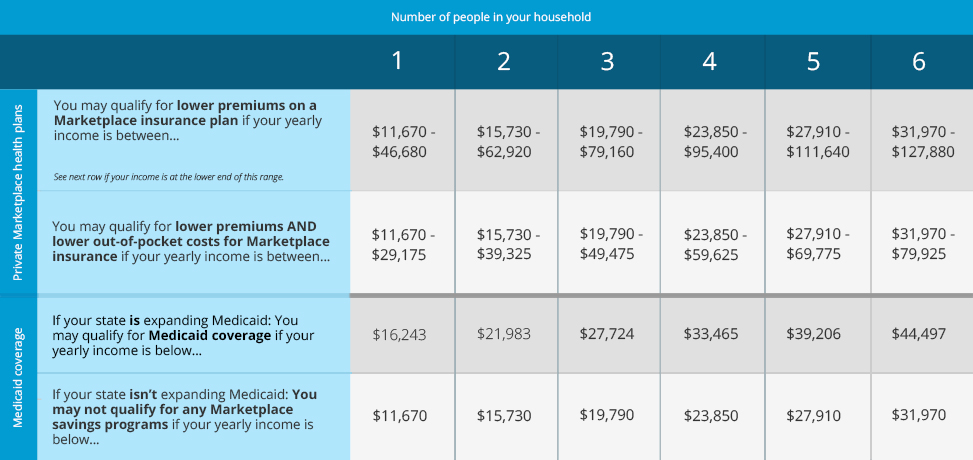

You can use this handy calculator from The Kaiser Family Foundation, it will estimate what subsidies you’ll qualify for. But you won’t really know until you actually plug your information into the marketplace. This Dough Rouller infographic is also super healthful for breaking down the subsidies. Below is a breakdown from Healthcare.gov of the subsidies and income brackets.

Premium Tax Credits: Eligible if your household income is between 133% and 400% of the Federal Poverty Level.

Cost Sharing Subsidy: You can apply for CSS if your household income is less than 250% of the Federal Poverty Level.

Medicaid: If you state has the option, Medicaid has been extended from those with income 100% of the Federal Poverty Line to 130% of the FPL Click here to see if your state extended the option.

4. Do I need to report a new job or life change?

If you already have coverage and you’ve applied for/or received a subsidy you still might need to report things to the government. According to the Healthcare.gov you are obligated to report major life changes, otherwise you may have to pay back your subsidy at the end of the tax year.

What are life changes?

- “If your income goes up or you lose a member of your household, you may qualify for less savings than you’re getting now. If you don’t report these changes, you could wind up having to pay back the difference when you file your federal tax return for the coverage year.”

- “If your income goes down or your gain a household member, you could qualify for more savings than you’re getting now. This could reduce the amount you pay in monthly premiums. You could also qualify for Medicaid or CHIP coverage.”

5. Don’t Rush

With looming deadlines and overwhelming information, it can be easy to rush through your healthcare application. The key is to take your time. Make sure you understand what benefits or cost reductions you qualify for. Many people have had to pay the IRS back for subsidies because they miscalculated. You don’t want to put yourself in that position.

If you missed the deadline, head over to Healthcare.gov to see your options. If you applied for a subsidy and received one, keep on top of the regulations and remember to update the government if something changes. We hope this helped clear up your ObamaCare Subsidy questions. If you have more let us know!