Imaging faster reimbursement cycles must include reviewing processes on both sides of the payer/provider relationship. Too many decades of combative mudslinging makes a comprehensive review and retooling difficult. New organizational structures, like ACOs, begin breaking down barriers allowing for collaborative improvements. RevCycleIntelligence.com gives two informative articles summarizing recent information.

Quantifying denial rates

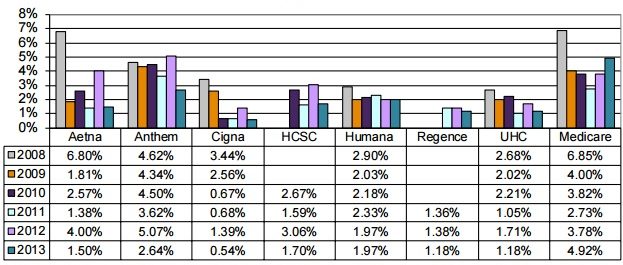

The most recent American Medical Association (AMA) national health insurer report card found. Anthem had the highest claim line denials with 2.64 percent of claim lines, followed by Humana with 1.97 percent, Aetna with 1.5 percent, and Cigna with 0.54 percent.

Providers may not have access to claims denial data from payers. Each payer develops its own rules for denying claims as well as how to communicate claim denials to providers.

Using manual processes

Manual claims denial management processes delay timely reimbursement. Michelle Tohill, Director of Revenue Cycle Management at Bonafide Management Systems, stated in June 2016.

“Keeping up with all the diagnostic codes and different insurance policies can be exhausting, but there are many software providers that will automatically update codes and requirements,” she said. “This cuts down on your research time, allowing your billing team to spend more time double-checking claims to make sure they meet every single requirement.”

Automating claim denials management processes can also help healthcare organizations identify errors before claims are submitted for payment.

Receiving preventable denials

Denied claims occur for a variety of reasons. A procedure may have been improperly coded on account of a provider. Care might have been performed outside of a beneficiary’s network. Only twenty-four percent of practices check patient eligibility every visit. Medical Necessity Criteria and related policies may not have been followed rendering certain care as medically unnecessary or experimental.

Poor documentation can also negatively affect the claims process. If a provider has provided incorrect, illegible, or incomplete documentation of a procedure or patient visit, it’s difficult to make an accurate or complete claim. In cases of sloppy documentation, the biller should contact the provider and ask for more information.

No EOB on denied claim, in certain cases, the payer may fail to attach the Explanation of Benefits (EOB) to a denied claim. In cases like this, it’s difficult to note the error on a denied claim, which slows down the (already slow) appeals process.

Appealing claims

The AHA reported in October 2016 that three-quarters of appealed Medicare claims remained at the administrative law judge level for longer than the 90-day statutory limit.

By the end of 2016’s second quarter, about 27 percent of all appealed Medicare claims were still held up in the appeals process.

The Medicare appeals process became so backed up that the Department of Health and Human Services faced a lawsuit calling on the department to resolve the backlog of cases. As part of the case, HHS reported that appeal hearings at the administrative law judge level were not typically held for 935.4 days despite a 90-day limit.

Ultimate Goal

Both sides benefit with well-documented care using appropriately detailed codes and forms, checked against medical necessity criteria and policies, and reimbursed accurately based on contracted services, because diligent work minimizes adverse determinations and the follow-up appeals. Sounds simple? Not really, though small and continuous improvements can be made with cooperation, activity report metrics, and on-going education.