| CLICK HERE and let us show how BHM’s economically maintain turn-around times and accuracy for new members. |

Despite rapid-fire growth that has resulted in upwards of 33% of all Medicare beneficiaries now being enrolled in Medicare Advantage (MA) plans, few health plans are proactively marketing their offerings to consumers and all but a select few plans are falling short when it comes to successfully addressing provider integration and access to care for their members. Those are the key findings of the J.D. Power 2017 MA Study.“Medicare Advantage plans represent a significant growth opportunity, but many health plans are not maximizing that potential,” said Valerie Monet, Senior Director of the Insurance Practice at J.D. Power. “Our data shows that the ability to deliver consistently strong customer satisfaction in the Medicare Advantage market is becoming a key differentiator for the leaders in this space and that satisfaction is achieved through a series of highly choreographed best practices.”

Following are some of the key findings of the study:

- Health plans missing premarketing opportunity: Enrollment in Medicare Advantage plans has been consistently growing. The proportion of the population age 65+ in the U.S. is projected to increase from 14% to 21% in the coming two decades. Despite the significant opportunity to capture share of this market as they qualify for Medicare benefits, just 11% of members in the 60+ age cohort indicate that they had received any communications from their health plan regarding moving from current coverage to a Medicare Advantage plan. Among the 11% who have received premarketing contact from their health plan, overall satisfaction scores are 52 index points higher than among those who received no marketing contact (762 vs. 710, respectively, on a 1,000-point scale).

- Just half of members completely understand how their plan works: Industry-wide, just 54% of Medicare Advantage plan members say they “completely” understand how their plan works. When it comes to the cost for prescription drugs, fewer people understand how this works compared with last year.

- Provider integration remains a friction point for most members: Ensuring members generally see their doctor as a trusted partner in their medical care is the most important factor driving the highest levels of overall satisfaction with Medicare Advantage plans. Somewhat surprisingly, it is not the soft skills that engender this feeling of trust, but rather assistance navigating the myriad of healthcare providers and managing associated costs that matter most.

- Coordination of care emerges as key driver of customer satisfaction: A new KPI in 2017 is found to be one of the most important factors driving overall satisfaction with Medicare Advantage plans—coordination of care among doctors and other healthcare providers—but most members say their plan isn’t able to effectively help them with this. On average, just 34% of Medicare Advantage plan members indicate their plans met this criterion.

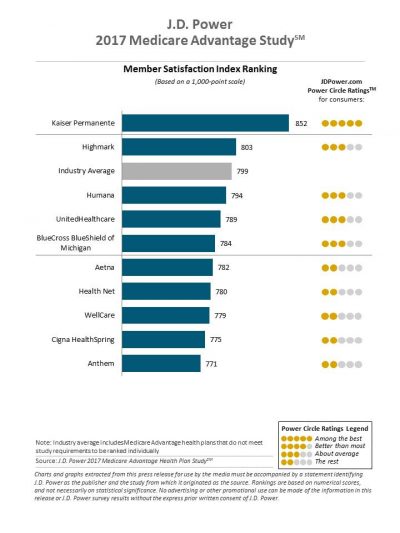

- Medicare Advantage member satisfaction stable year over year for most health plans: Overall satisfaction with MA plans is 799, on average, which is 9 points higher than the J.D. Power 2016 Medicare Advantage Study.SM Despite the significant opportunity to grow in this segment, only one plan improved the member experience significantly from the previous year, WellCare.

Increased Premarketing, Building Trust with the Physician Network

Are Keys to Success in Fast-Growing Market

Medicare Advantage Plan Customer Satisfaction Rankings

Kaiser Permanente ranks highest in Medicare Advantage member satisfaction for a third consecutive year, with a score of 852, which is 49 points higher than the second-ranked plan. Kaiser outperforms all other plans across five of the six factors that comprise the overall satisfaction index. Highmark ranks second with a score of 803 and Humana ranks third with a score of 794.

Kaiser Permanente ranks highest in Medicare Advantage member satisfaction for a third consecutive year, with a score of 852, which is 49 points higher than the second-ranked plan. Kaiser outperforms all other plans across five of the six factors that comprise the overall satisfaction index. Highmark ranks second with a score of 803 and Humana ranks third with a score of 794.

The study, now in its third year, measures member satisfaction with Medicare Advantage plans—also called Medicare Part C or Part D—based on six factors (in order of importance): coverage and benefits (25%); customer service (19%); claims processing (15%); cost (14%); provider choice (14%); and information and communication (12%).

The 2017 Medicare Advantage Study is based on the responses of 3,442 members of Medicare Advantage plans across the United States.

For more information about the 2017 Medicare Advantage Study, visit https://www.jdpower.com/resource/us-medicare-advantage-study.

CLICK HERE and let us show how BHM’s economically maintain turn-around times and accuracy for new members.