| Editor’s Note: Payers understand the importance of knowing the level of healthcare consumer engagement. Members want a more retail experience with healthcare. BHM review services supports payer processes for improving ways payers meet member expectations. Click HERE to learn more about the many ways BHM helps meet member expectations. |

Change Healthcare (CH) announced payer insights revealed in The Engagement Gap: Healthcare Consumer Engagement in 2017, a new national study of 89 payers, 251 providers, and 771 consumers. CH asked payers about the factors influencing their consumer-centric initiatives, and how these strategies are altering their organizations. Health plans surveyed were generally aligned in pointing to value-based care as the primary factor driving their focus on consumer-centricity, with 74% reporting it as the leading factor.

Payers and providers struggle to learn more about consumer behavior and figure out how to fulfill consumer expectations while maintaining fiscal stability.

The research sheds light on why and how payers focus on consumer engagement, where they’re investing, and differences in their priorities. It also reveals concerning gaps between what payers and providers think they’re achieving and what consumers are actually experiencing.

Investment in consumer engagement is a top priority for 80% of payers and value-based care is the top reason why, followed by competitive pressures and consumer demand for a more retail experience.

But while a third of healthcare IT investment dollars are earmarked for consumer engagement, 72% of consumers say their experience with health plans hasn’t improved or has worsened in the past 24 months. Less than 21% reported an improved experience. Moreover, consumer engagement is hampered by a “millennial gap” that shows older patients aren’t getting the attention they need to benefit from consumerization strategies.

“Payers, providers, and consumers sometimes have different agendas when it comes to engagement priorities and efficacy, and these insights are critical to informing investment strategies,” said Carolyn J. Wukitch, Senior Vice President & General Manager, Network and Financial Management, Change Healthcare.

“Consumers want new and better tools because they now have a greater financial responsibility. But the research shows technology investment is just a first step. Payers and providers have opportunities to capitalize on their investments, tailor experiences to what consumers want, promote adoption of these innovative services, and solicit feedback—and that goes double for the largest part of the population, older patients. Engagement requires more than tools alone.”

The report helps stakeholders see how the industry is responding to the consumerization of healthcare. In addition to priorities and drivers, the study outlines which engagement strategies are gaining or failing, what consumers are using and what they want, how stakeholders are collaborating, and more.

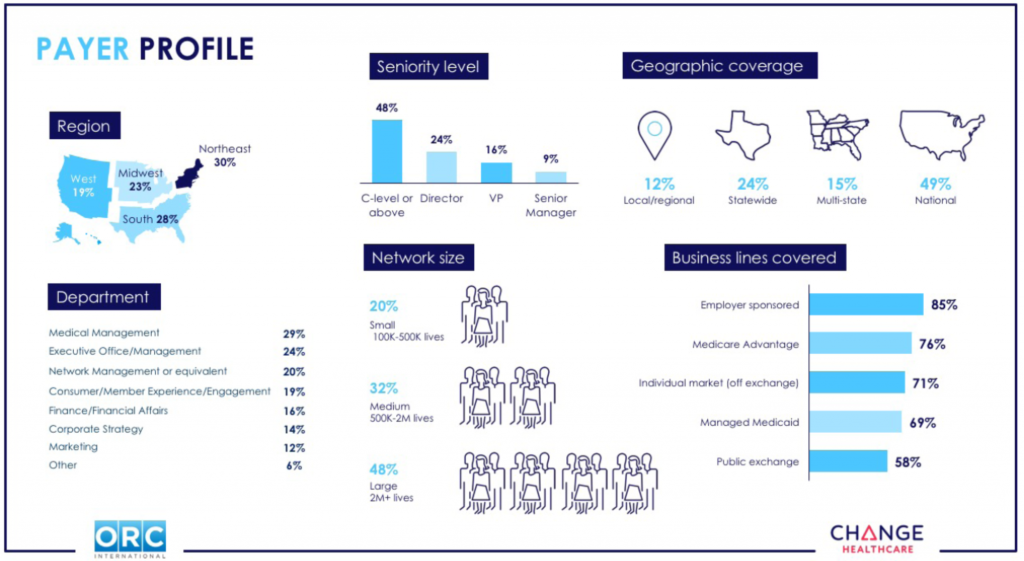

Payer and provider survey participants comprised senior executives, director level and above, across medical management, finance, technology, and strategy. All were screened to ensure their personal knowledge of their organization’s consumer-centric strategies, programs, and solutions.

The study also included 89 payer executives representing a similar geographic distribution across a range of organization sizes. These included Medicare Advantage, employer-sponsored, individual market (off-exchange), Managed Medicaid, and public exchange insurers; with 20% covering 100,000 to 500,000 lives, 32% covering 500,000 to two million lives, and 48% covering two million lives or more. The geographic coverage included 12% regional or local, 24% statewide, 15% multi-state, and 49% national plans.

The consumer base consisted of 771 individuals, demographically balanced to reflect race, gender, and income aligned to U.S. census results. Participants had to have seen a healthcare provider in the last year, and had to be covered by health insurance. Of these, 47% were covered by an employer-sponsored health plan, 29% had Medicare or Medicare Advantage, 10% had Medicaid or Managed Medicaid, 6% had individual insurance, and 6% were covered through a public exchange.