Industry Watch Alert

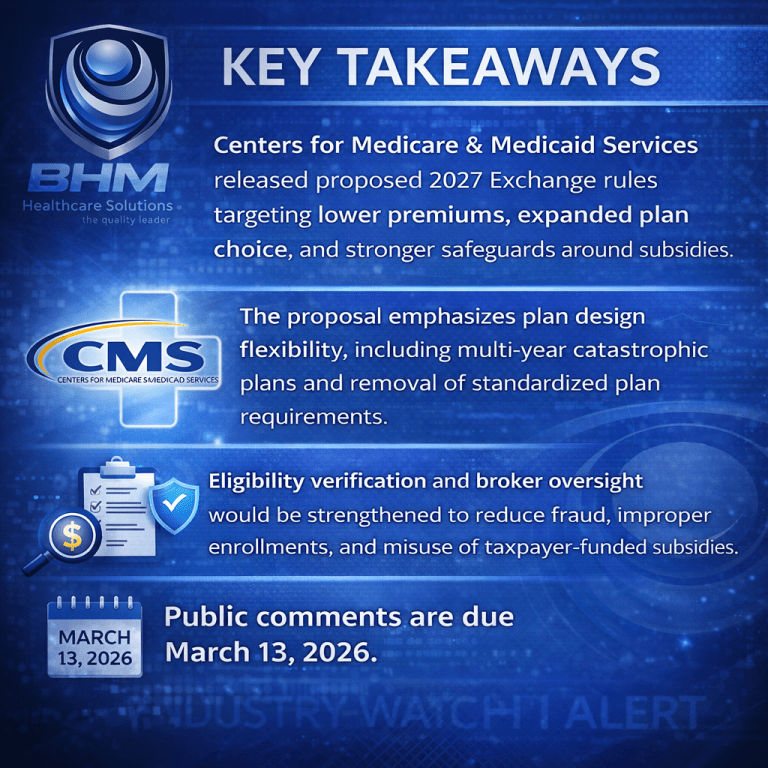

CMS’s proposed 2027 Exchange rule reflects a broader policy shift toward affordability, competition, and accountability.

For payer organizations, the proposal presents both opportunity and risk. Greater flexibility in plan design may support innovative offerings and differentiated products, while enhanced integrity requirements increase the importance of defensible eligibility processes, broker oversight, and operational controls.

Payers participating in the Exchanges should closely evaluate how these changes could affect product strategy, compliance workloads, and premium stability ahead of final rulemaking.

Frequently Asked Questions

What is the purpose of the CMS 2027 proposed rule?

The proposal aims to lower health care costs, expand consumer choice, and strengthen program integrity in the federal and state Exchanges.

How does the CMS 2027 proposed rule affect plan design?

It would allow multi-year catastrophic plans, repeal standardized plan options, and permit greater flexibility in deductibles, out-of-pocket limits, and network models.

What changes are proposed around subsidies and eligibility?

CMS proposes stronger income and eligibility verification to reduce fraud and limit subsidies to eligible individuals.

When are public comments due for the CMS 2027 proposed rule?

Public comments must be submitted by March 13, 2026.

Impact for Payers

If finalized, the 2027 Notice of Benefit and Payment Parameters would meaningfully reshape Exchange operations and plan strategy.

For issuers, the proposal removes several federal constraints that have limited innovation. Allowing catastrophic plans with multi-year terms, up to ten years, is intended to better align incentives around long-term member health management. Repealing standardized plan options would give health plans greater latitude to tailor benefit designs, cost sharing structures, and network models based on market demand.

From an operational and compliance standpoint, CMS is signaling tighter controls around eligibility, income verification, and subsidy administration. Enhanced verification requirements and updated Exchange policies would place additional responsibility on plans and Exchanges to confirm eligibility, including immigration-related standards tied to premium tax credits and cost-sharing reductions.

The rule also increases scrutiny of agents, brokers, and web-brokers. Clearer prohibitions on misleading marketing and stronger enforcement authority may reduce inappropriate enrollments but could also require payers to reassess broker relationships, oversight processes, and downstream compliance monitoring.

Finally, CMS proposes changes intended to curb premium growth by restoring fiscal discipline around Essential Health Benefits and modernizing network adequacy reviews. These updates aim to reduce duplicative oversight while increasing transparency around provider access.

BHM Perspective

As CMS strengthens affordability, plan flexibility, and program integrity standards, BHM Healthcare Solutions supports payer organizations with independent clinical review and utilization management services that reinforce accurate eligibility decisions, consistent coverage determinations, and audit-ready processes.

Previous Alerts

Sources

Each week, we email a summary along with links to our newest articles and resources. From time to time, we also send urgent news updates with important, time-sensitive details.

Please fill out the form to subscribe.

Note: We do not share our email subscriber information and you can unsubscribe at any time.

|

|

Thank you for Signing Up |

Partner with BHM Healthcare Solutions

BHM Healthcare Solutions offers expert consulting services to guide your organization through price transparency & other regulatory complexities for optimal operational efficiency. We leverage over 20 years of experience helping payers navigate evolving prior authorization requirements with efficiency, accuracy, and transparency.

Our proven processes reduce administrative errors, accelerate turnaround times, and strengthen provider relationships, while advanced reporting and analytics support compliance readiness and audit preparation. From operational improvements to strategic positioning, we partner with organizations to turn regulatory change into an opportunity for clinical and business excellence.