Industry Watch Alert

The White House recently outlined a policy agenda referred to as the “Great Healthcare Plan,” calling on Congress to pursue reforms aimed at lowering drug prices, reducing insurance premiums, increasing insurer accountability, and expanding price transparency.

For payer and provider leaders, the core question is operational, not political. What changes now?

The short answer is simple. Nothing yet.

The announcement is not a law, regulation, or executive order. It is a policy proposal that requires congressional action before any provisions become binding.

What it is and is not

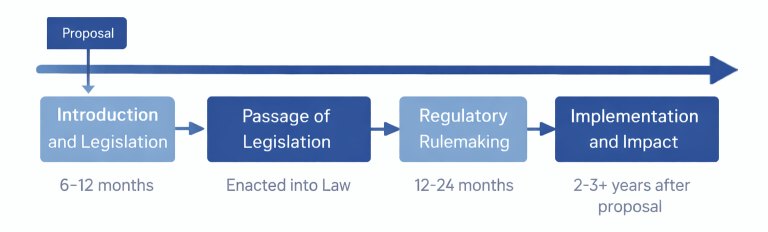

For this proposal to take effect, Congress would need to pass legislation. Federal agencies such as the Centers for Medicare & Medicaid Services or the Food and Drug Administration would then translate that law into regulations through formal rulemaking.

As you know, that process is typically measured in years, not months. Major healthcare legislation generally takes six to twelve months to move through Congress, followed by another twelve to twenty four months for rulemaking, stakeholder input, and phased implementation. Under a conservative but realistic scenario, meaningful operational impacts from a proposal of this scope would be unlikely to take effect for at least two to three years.

At this stage, the plan represents directional policy intent, not immediate compliance obligations.

What This Does Not Mean

For executive planning purposes, it is important to understand what has not changed.

- No new compliance requirements are in effect

- Medicare and Medicaid payment rules remain unchanged

- ACA subsidy structures have not been revised

- No new insurer or provider transparency mandates have been added beyond existing rules

In short, organizations are not expected to make structural operational changes based solely on this announcement but it is worth monitoring.

What Has Happened in Congress So Far

As of early February 2026, no specific legislation has been introduced to enact the Great Healthcare Plan framework. Committees have not scheduled hearings on the proposal, and its provisions have not been incorporated into budget reconciliation discussions.

Congress has been active on other healthcare matters. The FY 2026 appropriations package passed in late January included:

- PBM transparency and Medicare Part D reforms

- Extensions of Medicare telehealth flexibilities

- Hospital at home program extensions

- Site neutral payment reforms

- A Medicaid spread pricing ban

That package did not include the Great Healthcare Plan’s proposed subsidy restructuring or related provisions.

The FY 2026 consolidated appropriations legislation is available in official text as H.R. 7148, the Consolidated Appropriations Act, 2026. As of this update, the bill was placed on the Senate calendar and pending final Senate action and presidential signature.

This lack of legislative movement reinforces that the announcement remains a policy proposal rather than an imminent regulatory shift.

Exploring What the Proposal Signals

Even without legislative action, the announcement highlights areas that are likely to remain under federal scrutiny and are worthy of monitoring.

The framework points to renewed efforts to align U.S. drug prices more closely with international benchmarks and expand over the counter availability of certain medications. While broad reforms would require new statutory authority, the signal is clear.

Drug affordability remains a policy priority, particularly in federally influenced markets.

The proposal includes changes to subsidy structures and renewed funding for cost sharing reductions tied to the Affordable Care Act.

According to Congressional Budget Office estimates referenced by the White House, funding a cost sharing reduction program could save taxpayers at least 36 billion dollars and reduce premiums for the most common marketplace plans by more than 10 percent.

These figures are projections based on modeled assumptions and would depend on the final structure of any legislation.

The plan calls for ending certain pharmacy benefit manager payment arrangements characterized as increasing plan costs. This aligns with a broader bipartisan trend toward greater transparency and reform in PBM economics and broker compensation structures.

Proposals include requiring health plans to publicly report metrics such as claim denial rates, overhead versus claims spending, and plain language coverage comparisons. If enacted, this would shift transparency requirements toward consumer facing operational data, not just regulatory reporting.

The framework suggests expanding public price posting requirements for providers participating in Medicare or Medicaid. While hospitals already face transparency mandates, this signals potential expansion to additional provider types or care settings.

Strategic Takeaway

The “Great Healthcare Plan” announcement functions as a policy roadmap, not a regulatory action. It signals continued federal attention on drug pricing, insurance affordability, PBM economics, and transparency, but without legislative movement, it does not alter the current operating environment.

For payer and provider executives, the appropriate response today is strategic awareness, not operational change. The practical timeline for any material impact, if legislation were to advance, remains measured in years.

As federal policy conversations increasingly center on cost control, benefit design, and transparency, payers face growing pressure to demonstrate clinical integrity and financial accountability. As the quality leader in independent review, BHM Healthcare Solutions partners with health plans to strengthen utilization management, support consistent and defensible medical review, and provide independent clinical oversight that aligns operational performance with evolving regulatory and market expectations.

Previous Alerts

Source

White House

The Great Healthcare Plan

For real-time status of the FY 2026 appropriations bills including H.R. 7148, this resource from the Congressional Research Service provides official status tracking.

➡️ Appropriations Status Table: FY2026 (CRS)

Each week, we email a summary along with links to our newest articles and resources. From time to time, we also send urgent news updates with important, time-sensitive details.

Please fill out the form to subscribe.

Note: We do not share our email subscriber information and you can unsubscribe at any time.

|

|

Thank you for Signing Up |

Partner with BHM Healthcare Solutions

BHM Healthcare Solutions offers expert consulting services to guide your organization through price transparency & other regulatory complexities for optimal operational efficiency. We leverage over 20 years of experience helping payers navigate evolving prior authorization requirements with efficiency, accuracy, and transparency.

Our proven processes reduce administrative errors, accelerate turnaround times, and strengthen provider relationships, while advanced reporting and analytics support compliance readiness and audit preparation. From operational improvements to strategic positioning, we partner with organizations to turn regulatory change into an opportunity for clinical and business excellence.