Recent reports show that 89 new Accountable Care Organizations have now joined the Medicare Shared Savings Program, and now over 400 ACOs are participating in the program. So what are the new regulations for this group of ACOs? They seem to be changing over time.

Shared Savings Regs for ACOs

In December 2014, CMS proposed a change to shared savings regs for ACOs so that they could receive traditional fee-for-service payment as well as shared savings payment (if certain requirements were met.) This proposed rule change is projected to save about $280 million between 2016 and 2018, while also increasing transparency in healthcare costs.

It also has other implications. This rule change opens up a third type of shared savings with a savings rate up to 75% (compared to 50 or 60% in other tracks.) Other benefits include:

- Assignment of beneficiaries

- Waiver of three day hospital stay requirement

- Greater reward for assumed risk

CMS also proposed that track one ACOs be given the chance to re-up for another three years without major penalties (in hopes of reducing fears about the risk of this still semi-new program.)

Reaction to Regulation Changes

The American Hospital Association (AHA) gave their reaction to these regulation changes in the form of a letter to CMS Administrator Marilyn Tavenner. In the letter, they indicated that there still isn’t enough incentive being offered for the level of risk and burden it proposes. The letter states:

“While some of CMS’s proposed improvements are welcome and could be make the program more attractive to new applicants and existing ACOs, we question whether other proposals go far enough to correct misguided design elements that emphasize penalties rather than rewards.”

But they also offered some potential improvements that may help encourage more participants to come on board.

- Provide a longer time frame for organizations to learn the ins and outs without fear of penalties

- Focus on primary care and expand assignment options

- Use payment waivers to help with care coordination

- Re-think the benchmark method to keep ACOs from competing against themselves

- Provide more data and numbers for ACOs to study on the program

The Numbers

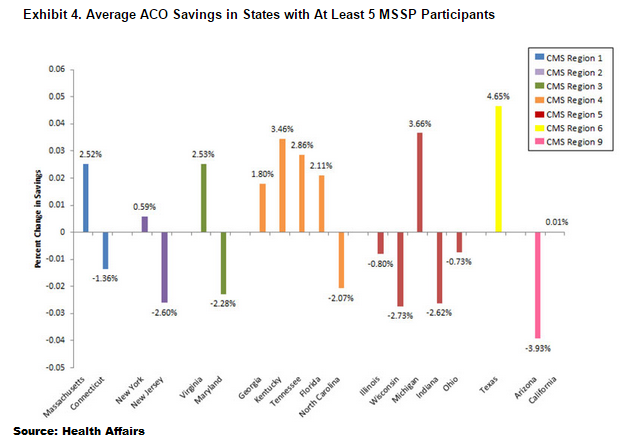

So what are the numbers so far? Health Affairs put together a study that sheds some light on the actual numbers on ACO savings.

Since the results on the financial performance front are still mixed, it’s hard to project if these changes in regulations for ACOs will make enough of a positive impact to bring other participants on board. CMS has encouraged current participants to increase their reliance on healthcare IT to make the transition happen more smoothly and efficiently–but again–it’s another instance of taking on new equipment and software (both expensive) that makes some hospitals not ready to commit.

What are your thoughts on the proposed changes to the Medicare Shared Savings Program?