| In recent news, a PwC healthcare report targets significant efforts in Behavioral Health and specialty pharmacy’s place with PBMs. See how our expertise in these areas, and claims review, keep your organization on ahead of the curve. Click to arrange for a free consultation. |

Healthcare trends are crucial to watch, as they help organizations predict changes in the industry and can help then make critical improvements to the way they do business. In previous week’s we looked at payer trends and payment trends. This week we are homing in on medical cost trends for 2017. From retail clinics to PBMs, there are many trends impacting healthcare spending. Cost is always a major topic of discussion for healthcare executives, so keep these in mind.

According to a Pwc report “2017 will be a year of equilibrium for medical costs. The forces that increase health costs are being tempered by a demand for value in the New Health Economy.” Adding, “Price, not utilization, is the force behind historical medical cost trend”

The Inflators: Convenient Care & Behavioral Health

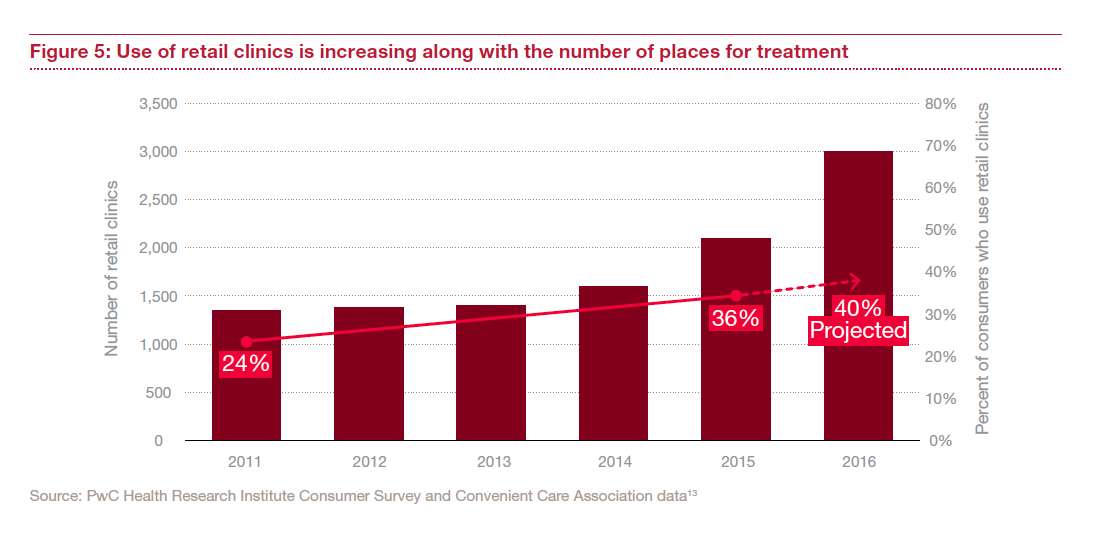

- Convenience does have a price tag. Healthcare organizations may have to embrace retail clinics or telehealth services to help close the gaps in care.

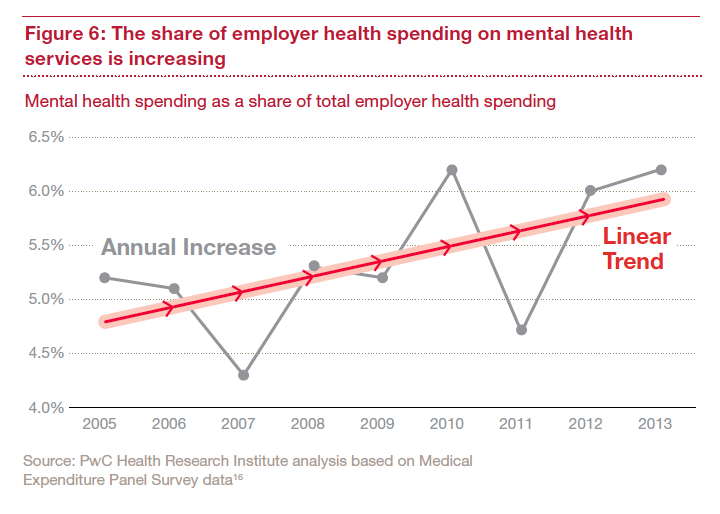

- Behavioral health access is increasing and mental health integration will be crucial for payer and providers. Behavioral health is a major player in the healthcare industry. Although an increase in mental health services and care is a cost reducer in the long run – it will be an inflator for 2017 spending.

The Deflators: High Performance Networks & Pharmacy Benefit Managers

- Performance is key. We’re going to see more forceful network strategies as employers look for other ways to reduce and control costs through performance based payments. Example: High performance networks that have more limited provider choices and may feature outcomes-based payments (Pwc). Provider networks will need to focus not only cost but quality and consumer preferences.

Fact: “Forty-three percent of employers are considering implementing this type of network in 2016.”¹

- Pharmacy benefit managers (PBMs) are becoming more aggressive they negotiate and manage drug costs. Specialty drugs have become neutral. Previously considered to inflate overall spending, Pwc does not expect specialty drugs as an inflator for 2017. PBMs may be taking a value-based-payment inspired approach and look for ways to pay by result and cure rather than volume.

To read the entire Pwc report click here.